Here are 4 ways Biden’s big climate bill touches Canada

U.S. President Joe Biden has announced a massive infrastructure plan intended to accelerate the transition to clean technology in a sprawling eight-year program that costs $2 trillion.

The plan also touches roads, bridges and broadband access; social policy, like public housing and funding for day care spots; and it raises and rearranges corporate taxes to pay for it.

But at its core, it’s a climate plan.

With the U.S. increasingly unlikely to impose a nationwide carbon tax or cap-and-trade system, Biden’s focus has shifted to spending record sums of public money on next-generation green technology — from 500,000 vehicle charging stations to a zero-carbon power grid to consumer incentives for electric cars and home retrofits.

“It’s not a plan that tinkers around the edges,” Biden said in a Pittsburgh speech Wednesday to promote what he’s calling the American Jobs Plan.

“It’s a once-in-a-generation investment in America — unlike anything we’ve seen or done since we built the Interstate Highway System, and the space race decades ago. In fact, it’s the largest American investment in jobs since World War Two.”

An effort this size will inevitably have effects beyond the U.S., and this one has a number of implications for Canada — some good, some bad and some to be determined.

First comes a caveat typical for any legislation proposed by an American president, and it’s that there’s no guarantee this will ever become law.

A bill hasn’t even been introduced in Congress yet and it already faces stiff Republican opposition, leaving one likely path to success, and it’s the narrowest one imaginable: if Democrats bypass the Senate’s normal 60-vote rule, they could try passing it through a budget process known as reconciliation, and that would require all 51 Democrats in the Senate, progressives and centrists, to unite around the bill.

This process will likely take months. In the meantime, here are some potential effects of the bill.

Economic stimulus hits the neighbourhood

When someone plows $2 trillion into your neighbourhood, the economic effects tend to spill onto your property.

For the neighbourhood of North America, there’s a general rule of thumb, according to Brett House, vice-president and deputy chief economist at Scotiabank: one percentage point of growth in the U.S. economy causes a half per cent increase in Canada.

In other words, enjoy the stimulus, Canada.

“Biden’s stimulus plan will not only benefit the U.S. economy but will also make Canada’s economy great again,” said Derek Holt, vice-president and head of Capital Markets Economics at Scotiabank.

“There will be significant leakage of U.S. stimulus into Canada as [U.S.] businesses and consumers buy more from America’s trading partners regardless of [Buy American rules],” said Holt.

Now, a word about Buy American.

Buy American: reality and rhetoric

There’s bad news for Canadian companies hoping to land some of these big U.S. government contracts.

Buy American provisions are inevitable in this bill.

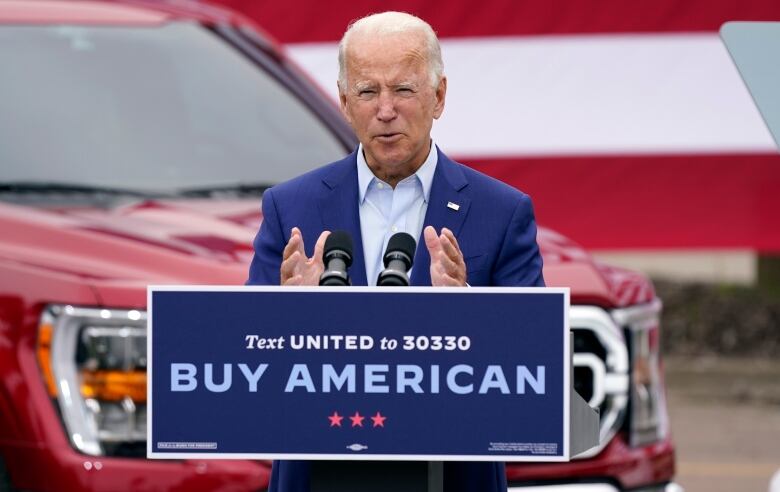

Biden promised during the election campaign that public contracts under his infrastructure plan would go to U.S. companies — and he doubled down on that Wednesday.

“Not a contract will go out that I control … to a company that is [not] an American company — with American products all the way down the line, and American workers,” he said.

Let’s see the fine print first.

The actual bill hasn’t been introduced yet, and only when we see those details will it become clear whether the reality matches the rhetoric.

For example: Will the bill address existing trade agreements? Under the World Trade Organization agreement on procurement, free trade is guaranteed for some types of public contracts.

There are other question marks.

What about the WTO’s anti-discrimination rules? A skeptical former U.S. trade official suggested it would be a flagrant violation of those provisions for the U.S. government to hand out subsidies for buying only American-made cars.

Then there’s the challenge of disentangling what even counts as an American car, for example, versus a Canadian and Mexican one. Vehicles are built in cross-border supply chains, with pieces regularly moving back and forth.

But make no mistake that Buy American provisions are coming.

Canada’s chief trade negotiator, Steve Verheul, all but conceded this the other day when he said Canada is simply hoping for exemptions for some sectors, like clean energy.

Energy and climate: Good news, bad news

The plan would certainly reduce U.S. carbon emissions, which are the second-highest in the world, after China. Biden wants the high-polluting U.S. energy grid converted to zero-carbon by 2035.

In the meantime, his plan would establish a clean-energy standard for power utilities to meet. This could mean new sales for Canadian hydro and alternative-energy companies.

For the oil sector, the news is less positive.

On the heels of cancelling the Keystone XL pipeline, Biden would scrap an existing credit in the tax code for U.S. companies that produce oil abroad.

One oil industry analyst in Canada, Rory Johnston, expects that to have, at most, a minor impact in the Alberta oilpatch. Not only has American investment there already dropped, but the sums involved in the credit are small.

The U.S. Environmental and Energy Study Institute cites one federal estimate that says ending the policy would be worth $12.7 billion, over 10 years, to all American oil companies operating around the world.

“[That’s a] very, very small amount in the overall scheme of things,” said Johnston, managing director at Toronto-based investment firm Price Street Inc.

But he said it’s yet another symbolic blow to the sector, revealing the political winds shifting against it.

A tilt in tax competitiveness

Could Canadian companies soon find themselves more competitive against their American peers, in terms of tax burdens?

Biden’s plan would raise U.S. corporate taxes seven percentage points, to 28 per cent, undoing some of the Trump-era cuts.

This would bring the U.S. back to its former international ranking: with higher marginal rates than Canada and almost every other developed country.

Jack Mintz, a tax expert and president’s fellow at the University of Calgary, said this is a long-term threat to U.S. companies.

He said they would be hit with a double whammy — first with a tax hike, then with the post-2023 phaseout of writeoffs built into the 2017 law signed by Donald Trump.

“There’s going to be almost a 50 per cent hike on the overall effective tax rate on capital in the United States between those two items,” Mintz said. “It’ll certainly make the U.S. less competitive.”

It’s not clear yet whether this helps investment in Canada, Mintz said. Because there’s another stick built into Biden’s plan — one designed to whack American companies that shift operations abroad.

Biden wants to end some tax exemptions for American companies drawing foreign profits and impose a new minimum international rate of 21 per cent.

Mintz called it a “Trump-like, America First-type strategy.”

Whether or not a U.S. company winds up facing a higher tax burden in Canada than back home will depend on other specifics of the tax code, and we’ll know more once we see the bill.

As for his general economic takeaway on Biden’s proposal, and its effect on Canada, Mintz said: “It’s hard to say whether it will be positive for Canada or not.”

www.cbc.ca 2021-04-01 13:04:16